By system of investing in commerce’s “original the following day,” it’s a long sport, and companies wish to strategize on their return on funding in constructing infrastructure for that original different.

By system of such funding scrutiny, the returns could perhaps take years. That’s why when I leer companies within the maritime sector working to invent infrastructure in a nation, my antennae perk up. Why? It’s rather straightforward.

If a firm is planning on spending hundreds and hundreds to invent a terminal or make distribution centers, it’s attributable to it expects future snort. It is furthermore a correct forward-taking a behold indicator of a nation’s future tainted domestic product attributable to manufacturing and constructing make jobs. Commerce is mandatory to constructing a nation’s heart class; expansion of the heart class is an energizer in world GDP.

India is potentially the most standard emerging nation the put you leer more funding pouring in and extra companies rising their manufacturing. Per discussions with logistics leaders, they are jubilant with India High Minister Shri Narendra Modi’s push for infrastructure measures to both toughen and prolong India’s roads to toughen the float of the transport of elevated manufacturing. The adjustments we’re seeing are a half of this long sport. All worldwide locations wish to commence somewhere. India could perhaps perhaps be a decade unhurried China, however keen into on the bottom ground is mandatory to shooting market piece and returns.

Increase doesn’t happen overnight, however it surely does must be nurtured. The early innings of this snort legend provide a special different for logistics companies — spruce and exiguous.

And while there are many headlines about India, that you just might’t ignore Vietnam. The diversion of manufacturing and the expand in investments by ocean carriers in that nation are far outpacing China.

Containers don’t lie

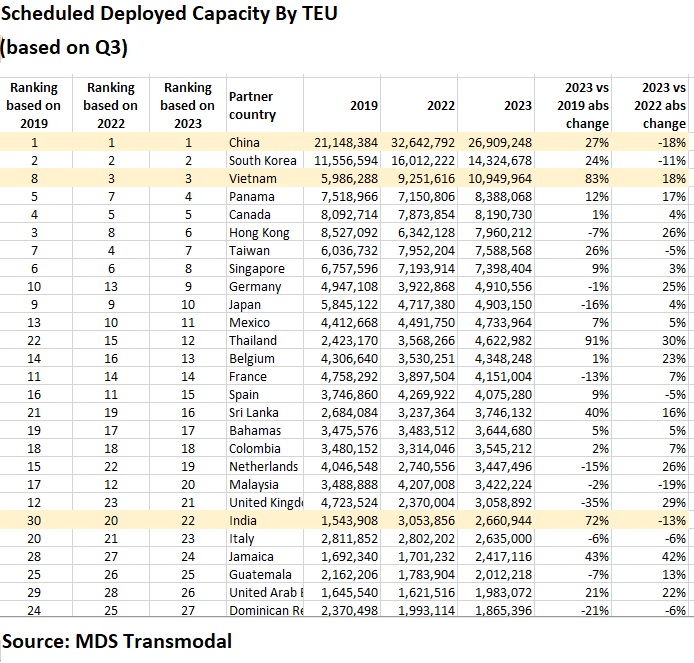

In step with data compiled by maritime transport data firm MDS Transmodal, Vietnam’s deployed capacity by twenty-foot connected units has considered an explosive 83% soar when comparing 2023 to 2019. India has experienced a whopping 72% expand. China trails Vietnam with a 27% commerce. In a 365 days-over-365 days comparison, China’s deployed capacity became as soon as down 18% in 2023 versus 2022; Vietnam became as soon as up 18%; and India became as soon as down 13%.

Antonella Teodoro, senior manual at MDS Transmodal, talked about Vietnam appears to be like to be main the urge to became the “brightest situation” unhurried China. The nation is bolstered by the multisource manufacturing amongst the Asian worldwide locations that’s been considered within the previous couple of years.

“Analyzing potentially the most standard inclinations within the capacity offered between the U.S. and its trading companions, our data suggests a necessary expand within the capacity besides to within the selection of liner companies and products offered on the Vietnam-U.S. commerce hall,” Teodoro talked about. “In the case of capacity, Vietnam is now the third most necessary partner nation for the U.S. — it became as soon as eighth put in 2019. Looking at the selection of companies and products, the commerce within the ranking is principal more profound: twenty third in 2019, now sixth.”

An instance of this logistics long sport is the arena’s greatest ocean carrier, MSC. In 2022, MSC-owned Terminal Funding Ltd. signed an settlement with Ho Chi Minh Metropolis to invent a $6 billion port within the Can Gio district, which is correct originate air of the metropolis in Vietnam. This might possibly be a transshipment “gargantuan port” and the basic section of constructing is anticipated to commence in 2024. The terminal project is a partnership with Vietnam Nationwide Transport Traces and Saigon Port. Through it, MSC is taking a behold to capture the expansion of commerce.

In India, CMA CGM is bullish on the emerging market. Ceva Logistics, a French 3PL that is a unit of the firm, obtained 96% of Stellar Price Chain Alternate choices in Mumbai. Rodolphe Saadé, chairman and CEO of the CMA CGM Personnel, has visited the nation and Peter Levesque, CMA CGM North American president and CEO, is scheduled for a talk over with.

Ceva agreed to manufacture 96% of Mumbai-primarily based entirely Stellar Price Chain Alternate choices from an affiliate of personal equity firm Warburg Pincus and other shareholders.

Looking at the selection of ocean string companies and products, easy sailings get hit China the toughest. India has held the same selection of companies and products, in holding with MDS Transmodal data. Vietnam is down correct one.

While transport lines are showing ardour in India with more companies and products and capacity allocated on this commerce hall, comparing the numbers to 2019, the adjustments are less necessary than as in contrast with Vietnam. Looking ahead to 2024, Peter Sand, chief analyst at Oslo, Norway-primarily based entirely Xeneta, an ocean freight rate benchmarking and intelligence platform, talked about he expects bigger export snort from Vietnam than India for 2024, calling the origins commerce within the China+1 a standard, slower burner. Moreover influencing the float of commerce in these areas is geopolitics.

“Vietnamese exports primarily to the U.S. will protect rising at a rapid run in 2024,” Sand talked about, “whereas India appears to be like put to advise the level that they’ll flip out to became a staunch plod-to position if you happen to could perhaps even wish to de-anxiety your offer chains away from over-reliance on China or any other producer within the Far East.”

The investments we’re seeing at the moment will totally toughen the arena of commerce for the following day.

Commerce will repeatedly float and the players within the logistics and provide chain are opportunistic. In expose for commerce to be a success, it should transfer. It is this is why commerce is agnostic and doesn’t play favorites.

China’s lockdowns, besides to the governmental pressures and geopolitical risks as of late, get knocked the nation off its pedestal of genuine cheap merchandise. Other worldwide locations get jumped in and seized on this weak spot.

We are in a thrilling time of commerce in which diversification of product choices is mandatory to a firm’s success. This involves investing in commerce’s original the following day.