FreightWaves’ Rachel Premack wrote an article on Wednesday outlining her experience attending a truck driver coaching convention in Corpus Christi, Texas, by the National Affiliation of Publicly-Funded Truck Driving Faculties (NAPFTDS). Premack sought to fetch more recordsdata on a essential disagreement in trucking that involves driver turnover and whether or no longer there is an ongoing driver shortage. Lobbying groups like the American Trucking Associations estimate there is an industrywide shortage of 78,000 drivers. On the more than a few side of the debate, researchers and the U.S. Bureau of Labor Statistics argue a high turnover price and broken labor market are guilty.

While on the convention, the debate centered around just a few doable solutions, in conjunction with more funding for driver coaching faculties; retention packages for novel drivers; adjusting driver pay scales; and changing the trucking industry model to encompass hybrid relay networks. In contrast to semi-random level-to-level over-the-motorway networks, hybrid relay networks resemble a much less-than-truckload network with drivers centered around terminals relaying loads between nodes while native drivers contend with first- and final-mile assignments. Price and profitability are challenges, as these networks require better freight volumes to quilt the additional drivers compared to OTR.

On the quit of the day, relationships between drivers and role of work workers appear to be a low-value in model-sense advance while industry leaders debate the finer minute print. Brent Lauber with Kelly Anderson Neighborhood advised Premack, “Contact that driver and pronounce, ‘Hi there, so-and-so will meet you on the entrance door Thursday morning.’ When they near in, buy that driver a cup of coffee or personal coffee there with them. Sit down with them and fetch to know the driver, fetch to know their family, fetch to know what they like and then clutch them around to the more than a few departments … to construct them feel welcome.”

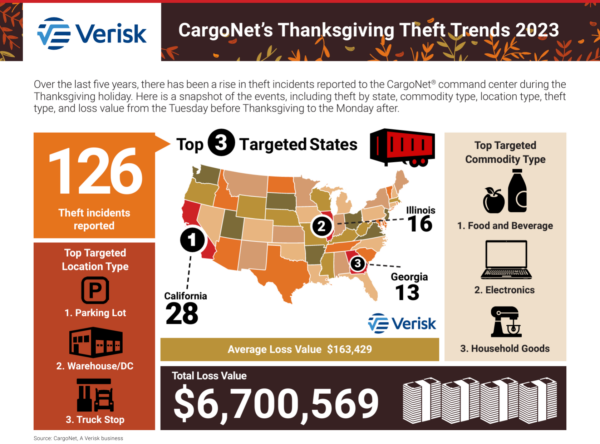

With the arrival of Thanksgiving, CargoNet, a cargo theft recording agency, is cautioning those in the industry of the rising model in cargo thefts. CargoNet’s recordsdata highlighted that since October 2022, the in model preference of experiences of cargo theft filed per week rose 64% to 51 per week the usage of recordsdata from January 2012 by October 2022. Looking out at recordsdata from Oct. 1 by Nov. 11, the quantity increased to 66 experiences per week, up 113% from the earlier decade.

Referring to the categories of thefts to glance out for, the Commercial Provider Journal stated, “The best packed with life threat is that of strategic cargo theft, in which thieves scrutinize to present a load by both impersonating a legitimate carrier, the usage of an authority they’ve registered or in every other case personal fetch admission to to, or deceiving a motor carrier into giving them credentials to necessary accounts.”

One home to glance for is the incidence of fraud process perpetrated by non-vow actors, especially in regions heavily uncovered to uncomfortable border trot. Karl Fillouer, vice president of gross sales at Circle Logistics, advised FreightWaves in October, “We are seeing a genuinely refined advance to faux process that’s doubtlessly being managed in one more nation or in some nation assorted than the U.S. This involves no longer easiest spoofing and monitoring gadget, but to boot constructing groundless domains for minute and large carriers.”

Market change: Pent-up quiz propels October Class 8 orders

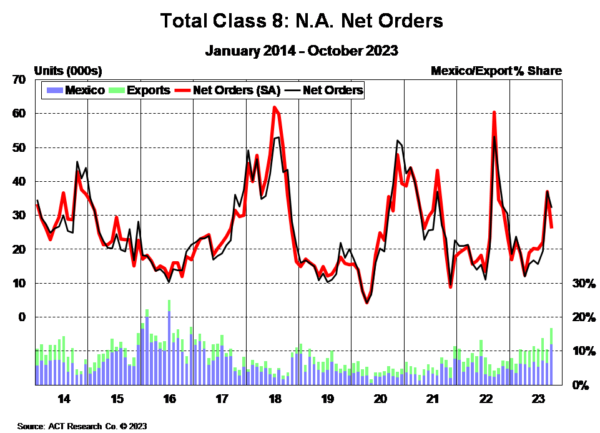

ACT Study no longer too long ago launched October fetch Class 8 orders recordsdata that showed lingering pent-up quiz despite comps down compared to the earlier year. Class 8 orders fell 24% year over year (y/y) in October coming in at 32,287 units, but breaking down the facts by segments yielded some surprises. The affirm well-liked the vocational straight truck market saw a 24% y/y develop while exports personal been up 91% y/y. Of those exports, orders going to Mexico rose 187%. The North American market fared worse, with orders down 34% y/y and U.S.-easiest tractor orders down 47% compared to October 2022.

Private quick additions and replenishment compared to for-rent fleets remain a constructing value looking at. Kenny Vieth, ACT president and senior analyst, stated, “For carriers, the long backside in freight rates continues, with plight rates limited changed since April. A substantial driver of price weak point has been lagged private quick capability additions. As for-rent fleets are inclined to be the first investors in line, private fleets personal been the drivers of Class 8 market power in 2023, in conjunction with equipment on the backside of the cycle and prolonging the velocity bother.”

One other recordsdata provider, FTR Transportation Intelligence, echoes the sentiment that quiz stays real despite freight market weaknesses. FleetOwner reported Eric Starks, chairman at FTR, stated, “Invent slots continue to be stuffed at a wholesome price. The total affirm for truck quiz is real. Despite freight weak point, fleets continue to be sharp to repeat new equipment, striking forward our expectations of replacement quiz all the design in which by 2024.”

FreightWaves SONAR highlight: Plight price forecast cleared for takeoff

Summary: Plight rates are forecast to sharply upward push in the weeks by Thanksgiving and main up to Christmas, according to the FreightWaves National Truckload Index Forecast, 28-Day Outlook (NTIF28). The new NTI plight price is $2.26 per mile all-in but is anticipated to upward push 15 cents per mile, or 6.64%, to $2.41 by Dec. 19. This comes as recent NTI plight market rates rose 4 cents per mile in the past week from $2.22 on Nov. 13 to $2.26 per mile.

Plight price seasonality seems to be to be a ingredient, with plight rates rising by December sooner than step by step declining in January when truckload capability normalizes and drivers return to work in force, using plight rates relief down. Vacation disruptions from Thanksgiving by New three hundred and sixty five days’s can even be attributed to drivers taking extra home time, which creates localized capability deficits in both plight and contract markets. Fleets continue to prioritize improving working tractor percentages while juggling driver home time wants and diminished in measurement freight tasks.

The week of Thanksgiving can even seek a upward push in outbound subtle volumes as shippers entrance-load final-minute shipments sooner than their companies and products terminate for the commute. Outbound subtle quantity rates remain elevated month over month from 10,993.74 facets on Oct. 21 to 11,476.43 facets, an develop of 482.69 facets or 4.4%.

The Routing Handbook: Links from all the design in which by the fetch

The logistics of turkey day (FreightWaves)

One other decline in common diesel pump prices; OPEC+ meeting looms (FreightWaves)

U.S. District Court docket hears AB5 arguments (Land Line)

Trailer Show Season Continues to Present Solid Bookings Despite Lingering Freight Recession (ACT Study)

Brokers, carriers might also be targets of groundless DAT location (FreightWaves)

LMI exhibiting transportation market flip is coming (FreightWaves)